The Telecom Expense Management (TEM) Industry Has to Change Part 1: The Industry

An 8-Part Series

The Telecom Expense Management (TEM) Industry Has to Change

Part One: The Industry

Series Overview

AOTMP® is a 19-year-old company that has both vendor and business customers in the telecom, mobility, and IT management industry. We have been consultants and trusted advisors for all customers in the past. We have collected data from our database of over 100,000 emailable industry professionals. We know what works. We know what doesn’t. Today, AOTMP® is an information services company supporting telecom, mobility, and IT professionals across the globe through training, certifications, association memberships, events & programs, best practices, publications, resources, and professional development.

We see the great relationships. We see the churn. We hear about the great buyers and the unreasonable buyers. We hear about the effective and the ineffective vendors. We see the buyers who will never have a successful TEM program until they change internally. We see the sellers who will say anything and go beyond reasonable ethics to get a deal.

We hear the vendors who say they have never lost a customer, yet we can easily dispute it. We see the enterprise buyers who put 100% of the blame on their vendor, yet the greatest challenge is within their own organization. We see the many happy relationships and we see the many relationships that just exist because it’s too painful to change. And we see the major investor wins along with huge investor losses in the tens of millions of dollars. We see it all.

Armed with this insight and experience, we have decided to author this eight-part series, not to just point out all the challenges, but to bring awareness to all the growth opportunities right in front of us if we can work together to affect change. It must start somewhere, and it starts with one vendor and one buyer, then two vendors and two buyers, and builds from there. For more on the motivation behind this, please see page 25.

We believe the greatest opportunities for growth for both the vendors and the businesses lie in five core areas.

Improving the buy and sell process.

Agree to open and transparent communications throughout the process, regardless of the issue.

Developing stronger vendor – customer partnerships.

Problems are going to happen; commit to focusing on solutions, not penalizing each other.

Focusing on value beyond cost savings.

Help each other identify, quantify, and realize value beyond cost savings.

Building world class telecom and mobility management Centers of Excellence.

Work together to build environments that contribute to overall strategic business results.

Accelerating buyer and seller growth opportunities.

Help each other identify opportunities for growth in their respective businesses.

The TEM Industry has to Change An Eight-Part Article Series

We’ll be publishing these eight articles between September and December 2022. Be sure to subscribe to AOTMP® Insights to be notified of the latest releases.

- So much has changed and yet so much has stayed the same.

- $4+ trillion in products, services, and solutions … a huge industry.

- There is a reason we can’t get more than a handful of $50 million plus TEM providers.

- Why is it that many other industries have gone from nothing to billion-dollar industries … but not TEM?

- The service provider environment – carriers, mobility providers and others.

- Call it technology, cloud, SaaS, network, or anything else … it doesn’t fix the problem.

- Why is there so much churn in this industry?

- We’re stuck in the past – the hamster wheel

- The impact of private equity – what it has helped and what it has not.

- Opportunities are everywhere … for businesses, for vendors and for financial partners.

- Quotes, recommendations, or commitments from our sponsors.

- When will enterprises place value on other aspects of TEM, and not just cost savings?

- Is there value on just having an accurate inventory?

- Is there value on just getting your invoices processed and ready to pay on time?

- Is there value on leveraging the buyer knowledge with seller technology?

- How do vendors better demonstrate value other than hard-dollar cost savings?

- A great presentation with not one word of hard dollar cost savings … would a buyer buy it?

- How do organizations like Salesforce or ServiceNow sell without a focus on hard dollar savings?

- Quotes, recommendations, or commitments from our sponsors.

- What must change in the selling and buying process?

- Procurement has a role, but it’s not to stop all communications between the buyers and the sellers.

- Communications must change, be more transparent and open throughout the process.

- The fishing expedition – why do enterprises send out 300 question RFP’s, make the TEM vendors jump through hoops, when they plan to stick with what they have, or they don’t even have budget approval?

- What do the vendors gain by pitching smoke and mirrors and saying they can do everything, even when they can’t?

- You’re looking for your 4th, 5th, 6th or even 7th TEM provider. Isn’t it time to look in the mirror?

- You’re pitching to an organization on their 4th TEM provider? That should prompt a different discussion.

- Quotes, recommendations, or commitments from our sponsors.

- Say What? The $30 million annual spender who saves $1 million each year. Soon it should be free?

- The more spend I manage, the more I need to charge versus the more savings I create for my customer, the better I am.

- My TEM provider is no longer saving me any money and therefore I can’t justify the cost and need to change providers? Is the provider doing a poor job or a good job?

- Save Me Money? Yes, but not so much that it makes me look bad.

- What do you mean you found me $5 million in savings? That’s going to cost me my job.

- The CIO of a $100 million spender who said “if you save me more than $1 million a year, you will be fired”

- It’s Ground Hog Day. I keep saving the same money over and over again.

- What about the root cause? Where is the focus on the core challenges?

- Quotes, recommendations, or commitments from our sponsors.

- When will there be real partnerships created between buyers and sellers?

- Why is it that buyers and sellers can’t seem to communicate at the first sign of trouble … and it only gets worse from there?

- When will the enterprises realize that there is no perfect solution in this very complex and difficult industry?

- When does an accurate inventory become the most important discussion point?

- Everyone wants a great relationship, but enterprises oftentimes don’t let the vendors talk to the business owners during the initial sales process. How does that create a foundation for a successful relationship?

- The Quarterly Business Review (QBR) … the focus needs to change. It’s not about all the great things we have done. We just love to drive from the rear-view mirror and you know how that ends up.

- Quotes, recommendations, or commitments from our sponsors.

- What is a Telecom and Mobility Management Center of Excellence anyways?

- Vendors and business customers really can work together to build a world class telecom and mobility management environment.

- Who are the critical stakeholders on the vendor side and what role do they play?

- Who are the critical stakeholders on the enterprise / buyer side and what role do they play?

- Telecom and mobility management functions don’t need to be the support organization in your company – position it to be a driver of business results.

- How do all parties show more value and contributions to the business?

- Quotes, recommendations, or commitments from our sponsors.

- AOTMP®’s top five recommendations to buyers.

- Recommendations, or commitments from our sponsors.

- AOTMP®’s top five recommendations to sellers.

- Recommendations, or commitments from our sponsors.

The Industry

What Industry?

Before we even start with the industry, I must regress for a minute. The Pandemic. How could we ever forget the Pandemic. We were all glued to our mobile devices, the TV, or whatever other screens, holed up at home trying to make sense of what was happening. Every day we heard about all the heroic efforts of the first responders, the police, the firefighters, the health care workers, and many others. They were on the front lines every day working to save lives and keep us all safe. We applauded them all, and we should have.

But every one of them relied on their mobile devices, their connectivity, and their general ability to communicate with the world. Who kept that going and helped manage it all? We did—the telecom, mobility, and IT management professionals around the globe. But it goes further than that. Not only did we make sure they could communicate, but also, we moved millions of workers, and their ability to communicate, from offices to remote set ups at the same time. We did it in days. Did you hear me? Days! How important was that? What would have happened if those various individuals, teams, and organizations were not able to communicate? Who did it? We did it. The telecom, mobility, and IT management professionals across the globe.

I didn’t hear our role, and how critical it was, mentioned once on the news, let alone every day like the others. It’s just one more confirmation of how people look at telecom, mobility, and IT management professionals and the industry. I guess it all goes back to us being tagged as just the “unseen team behind the scenes.” Just stay in the back room and keep things connected and running and everything will be fine. In other words, you’re not that important. Well, that’s hogwash, especially today. And we need to change that. We are a very critical part of every organization across the globe. We are part of the supply chain, the sales, the customer experience, and much more. We are part of everything and every role. Without communications and connection, the world shuts down. Without us managing it, the world shuts down. We are critical, yet don’t get the attention we should, not just for the recognition, but for the strategic asset we are and can be. It’s time for all of us to change that.

Ok, enough on that. We don’t have an industry, let alone a recognizable or respected industry. Telecom expense management, where it all started, has evolved with mobility management and now IT management. And it’s all starting to blur. So much of our communications and networks and everything else have now has evolved beyond telecom and mobility and into the cloud. Traditional telecom is now on our mobile devices in the form of a software license, and the list of technology change goes on and on. So, in this telecom, mobility, and IT management world we live in, IT management is huge. It involves managing all the licenses, managing all the cloud solutions, and so much more. It is endless, but for the purposes of this paper series, let’s just say IT management is managing the cloud user licenses and functionality behind it all that is necessary for our jobs every day.

In a global market sizing study AOTMP® did in 2019, it was determined that $3.8 trillion in services, solutions and products were being sold, and bought, in this telecom, mobility, and IT management industry each year. Cloud infrastructure migration and increased technology enablement demand resulting from the Pandemic continues to drive annual investments well past the $4 trillion mark. That’s a lot of dollars to buy, to sell, and to manage. And who does it? We do it.

That gets us down to this telecom expense management industry, which has evolved to include mobility and technology, including the cloud aspects. The $4 trillion annual global spend continues to grow, yet we still can’t seem to get traction on creating large global providers in this telecom, mobility, and IT management space, specifically telecom expense management. We also can’t seem to create Centers of Excellence or strategic environments within customer environments that make a greater contribution to their businesses.

So much has changed in this industry since the late 90’s and early 2000’s with bill auditing and then TEM technology, and yet so much has stayed the same. We continue to innovate on both the buyer and the seller side, yet we see marginal improvement in revenues on the seller side and marginal improvement in efficiency and value creation on the buyer / business side. We still don’t have a model that is disruptive or industry changing. We still don’t have a significant number of role models on either the vendor or the business buyer side. We still process invoices, audit them, fix the constant billing errors, and more. By the way, on billing errors, how much of that is on the providers and how much of it could be fixed on the buyer side with the right processes in place? We tend to blame it all on the service providers, and many times rightfully so, but fixing or changing processes on the buyer side could make a significant positive impact. We would argue that more than 75% of the inefficiencies could be fixed just with changes in the buyer environment. It’s a given that there are so many issues and inefficiencies with the service providers and fixing that is an even bigger challenge. It’s a bigger challenge than the one we have with just managing what we do have with the hands we are dealt. We spend so much time complaining about the service providers when we, as an industry, should use that time to fix what we can control. We have plenty of our own work to do, and it could make a significant positive impact on industry growth.

So, what do we have as an industry? We have marginal year over year improvement on both the buyer and the seller side. We have so much of the TEM vendor business just stealing business from each other to get revenue growth. We have businesses unhappy with their providers. We have businesses so tired of change that they don’t change. We have buyers that are impossible to make happy and think every TEM provider should be perfect. We have very few providers over the $100 million revenue mark. We have very few businesses operating at even an 80% efficiency level. Oh, and we don’t even have many ways to measure success beyond cost savings. And when we do, nobody cares. Our favorite question to ask both buyers and sellers is “how do you measure success beyond cost savings?” So, while the “industry” continues to grow marginally with great success stories here and there, we don’t have a recognizable industry with the big players that add credibility, nor do we have the huge volume of successes or recognition of value, at any level, that there should be on the business side.

How is it that the IT service management (ITSM) industry and ServiceNow can grow to a multi-billion-dollar industry and business, but we can’t? How is it that the related bill-pay industry can grow to a multi-billion-dollar industry, and we can’t? And how can someone like Salesforce.com grow to a multi-billion-dollar organization in less than 20 years, and we can’t? Their business value has nothing to do with cost savings. It’s quite the opposite. They say, “Make a big investment with us, and we are going to impact your business.”

We talk cost savings as our industry value pitch. The CRM industry talks efficiency as their industry value pitch. What does that tell us? Do they pitch features and functionality as hard as we do? Or do they pitch business outcomes? Think about it from an executive standpoint for a minute. We are all very proud of the money we save every year in our telecom, mobility, and IT environments. We are just awesome. The executive just sees a line item that is going up quarter over quarter and year over year. What does that tell us? It tells us a lot.

We just keep running, trying everything.

This industry is just running on a hamster wheel. We are at full speed, and keep running, harder and harder. We are not running in circles. The wheel is going in circles, but we are staying in the same place. We are a tired industry that needs a jolt and needs to be knocked off the wheel. Yet, we just keep running hard and going nowhere fast.

We have tried so many models. We have done and do the contingency audit-based models. We do managed services. We have charged based on a percentage of spend or a percentage of savings. We call telecom and mobility management, technology management instead. We add on payment processing. We develop new features and functionality. We add on SaaS and all kinds of other acronyms to our solutions. We manage and audit cloud bills. We add on license management, and we add on utility management. We are trying everything, yet we see marginal growth.

Call it technology management, cloud management, SaaS, network, or anything else you want. It doesn’t fix the root cause problem that sits right in front of us…the one that hampers industry growth and value. The bottom line is that we need to quit trying to change the lipstick on the pig and get down to all the real opportunity for change that sits before us.

One of the most interesting things we watch unfold is the great movement into managing cloud spend. Telecom and mobility management providers pitch and try to take on cloud spend for the customers. The first issue is we haven’t even mastered telecom and mobility spend and efficiency in business organization yet. The second issue is that the person often responsible for managing telecom and mobility spend is not the same as the person managing cloud spend. But the most interesting thing we see unfold is bill auditors trying to “audit” cloud bills like they audit telecom and mobility bills and wonder why they are not finding the billing errors. This is not everyone, but we often see auditors or analysts looking for billing errors instead of being focused on usage and users and what that data tells them. The bottom line is managing cloud invoices is totally different than managing telecom invoices.

But speaking of the hamster wheel this industry lives on, there are two things we need to focus on to take a step out of the wheel. Right now, TEM vendors and business teams are often fighting fires and looking in the rear-view mirror (reacting). In return, they are two steps behind the business needs. They are reacting, not changing the expense management model. Secondly, the TEM vendor teams are often focused on adjacent spend categories before mastering telecom and mobility, as just one example. There is plenty more value to provide both by the TEM provider and the business long before we get into the adjacent spend categories. Let’s not try to be all things to all people. Let’s, instead, be really good and capture the many opportunities that sit right in front of us within our core competency.

On a macro level, this industry spends its time driving while looking into the rear-view mirror instead of looking forward.

It gets the same results as if you drove your car by looking into the rear-view mirror. We must change that. We need to stay focused on what we are good at and always be looking forward. If we continue to drive by looking into the rear-view mirror, and in reactionary mode, we will never move forward.

Who Really Cares

Why or Why Not?

Who cares about what we do? Does the TEM team care? Absolutely. Does the IT team care about what we do? Maybe. Does the leadership team care about what we do. No. How do we change all of that? We need to and we can.

Why doesn’t the leadership team care? What are we giving them to care about? Like we previously mentioned, we are all proud of the savings we produce. The leader team, not so much. All they see is an expense line item going up every year. Who cares about that? There is nothing strategic about saving a few dollars in a small piece of a much larger overall operational cost. They likely don’t even see what we save. It doesn’t even hit their radar…the increasing overall expense does, though. We must give them something to care about. See our favorite stories later in this article.

Do we currently provide leadership with anything they care about? Not really. Is there anything strategic about what we do? Not in most minds. But we can change that. We can barely get the attention of IT leadership, let alone company leadership. We can change this industry if we can get the attention of IT leadership and overall company leadership. But right now, leadership hardly cares.

We will argue all day long that the first conversation in any buyer and seller relationship should be who cares about what. First, what does the company leadership team care about? Second, what does the IT leadership team care about? And finally, what does the telecom and mobility team care about? And it should be in that order. Yet, most times we start with the telecom and mobility team, or worse yet, we start with what new features and functionality do I need or can I sell you. That’s a death sentence. If we are going to move the industry forward and create more value and opportunities for the buy side and the sell side, we need to change. We need to start with the leadership team. If we know what is important to the company leadership team and then the IT leadership team, we have a much better shot from so many perspectives. We might not be able to match or provide value to everything that is important to leadership, but we promise, you can tie telecom, mobility, and IT management to some of it. It’s a start in showing that telecom, mobility, and IT management can be a strategic asset to the organization instead of just a cost. Can telecom and mobility have a positive impact on revenue growth? Absolutely. Show them how. Can telecom and mobility have an impact on customer retention? Absolutely. Show them how. The list goes on and on.

At some point we can discuss getting the message out, created by the internal TEM team and the TEM provider together, in the form of a newsletter, update, or other communication on a quarterly basis that speaks to the value being provided to the organization, how it is tied to company and IT leader initiatives…and beyond cost savings.

Let’s talk about reports and then QBR’s. We can’t even begin to tell you the thousands of reports we have seen, generated both by vendors and buyers, which get distributed and never read, or they are read but the reader has no idea what they mean or what they tell him or her. So many reports and so little action. 90% of the reports are looking into the rear-view mirror. That’s ok, but the time needs to be spent on flipping that data into forward-looking insights. What does it tell us? Where are the reports that tie into the business value we are going to provide to the company leadership team that they care about? Where are the reports that tie into the IT leadership and the value we are providing to them? Bottom line is we need reports, but have we educated the readers on what they mean, what to do with them, what the risks are, etc.? They should tell us what we need to plan for and most importantly, what overall business value they provide. If we, as a telecom, mobility, and IT management industry cannot demonstrate overall business value to the organization, we will continue to run in our hamster wheel and go nowhere fast. We must tie our solutions into the business value that others care about.

And we can’t go without talking about QBRs and the value of QBRs. We have been openly part of, or behind the scenes listeners on, hundreds of QBRs over the years. For the most part, but not always, they take the format of 80% here are all the great things we have done and the value we have provided (rear view mirror), 10% about the challenges we need to deal with, and 10% on here is what else I need to sell you. Again, not always, but that is a common theme. I would argue that it needs to be flipped and totally refocused. 10% should be what we have done in the past, 25% on what both sides can do to fix what could be better, 40% on opportunities and planning for the future to add value, without either side investing more money, and 25% on jointly working on mapping the value being provided to the IT leadership and the company leadership. There is no reason to spend time on a sales pitch. Additional solution needs from the buyer will come naturally out of these other conversations. And every QBR should have an overall focus on what business problems is TEM really solving?

Ideal QBR Format

10%

Review of the Past

25%

Current issues

40%

Growth Opportunities

10%

Leader Initiative Mapping

And by the way, we will talk more about this in the relationship part of the Series, but the QBR term should be blown up in our industry and referred to instead as the QBW (Quarterly Business Workshop). BONUS POINTS: We will be very happy at AOTMP® when we see the first business customer or vendor who shows us their QBW agenda in a format outside of the past norm.

IT leaders or company leaders might not care right now, but it’s our role to start the education process. We can make an impact on business results. We can contribute to business strategies. We can help create the future. We can contribute to the initiatives important to leadership.

The Churn

Why is there so much churn in this industry? AOTMP® listens intently to buyers and business customers to gauge satisfaction with their providers. 65% are discontent or downright unhappy with their TEM provider. Of that majority, approximately 35% are planning on moving from their TEM provider and approximately 30% feel stuck because it is too painful to move. So, with two-thirds of business customers not satisfied, churn is no surprise. Here are the themes we have seen over our 19 years, and they still hold true today:

At the first sign of trouble, it’s time to move providers.

We are lacking open and transparent communications. We penalize instead of partner. This is a tough industry and there are going to be issues. Plan on it. Work together and prepare.

At the first sign of low savings, it’s time to switch providers.

Where’s the other value? That’s the problem. It wasn’t sold on other value. There wasn’t other value created. Savings guarantees funded the purchase and with the savings gone, the provider is gone. But isn’t having little savings a good thing…your environment is operating efficiently, or no?

Vendors pitching so much smoke and mirrors instead of what they really can do and what they can’t do.

More respect will be given when you say “no” or “no, but we would love to partner and work together to figure out how to make that happen in the future for both of us”.

Neither side spends enough time talking through requirements, planning, contingencies and so forth.

This should be like building technology. The more time you spend on requirements and planning and getting that right, the quicker and easier it is to get it built and the less rework and fixes you have, all of which cost time and money.

With a majority of the relationships that go upside down, it happens in the implementation phase and never recovers.

Plan for the worst. Know that it is not going to be perfect. Know that telecom and mobility is complex and fast changing. Know that things change hourly.

Rarely does anyone go into this, on either side, talking a lot about the challenges they are going to have and how to manage them. Oftentimes the sense of reality in our complex world is missing.

Instead of spending all the time talking about how great everything is going to be, both parties need to talk about all the contingency plans, communication plans, likely issues, etc. Create a real partnership, not the lip-service partnership we see all too often. It is rarely going to go as good as either side would like. Plan on it and talk about it.

The bottom line is that this industry can never become a thriving industry if we don’t fix the churn issue. We see providers just surviving on take-away deals. That tells us something. This industry and dealing with the service providers is hard. We know that. But there is so much we can control if we work together as true partners on the buy side and the sell side of managing the environment. There are significantly more revenues to realized. There are significantly more efficiencies and business value to provide. We can be a strategic asset and drive business results if we change our view on each other. We need to make this happen together. We are the good people, working in a very complex industry. We are two very different groups of people who need to spend more time partnering for change.

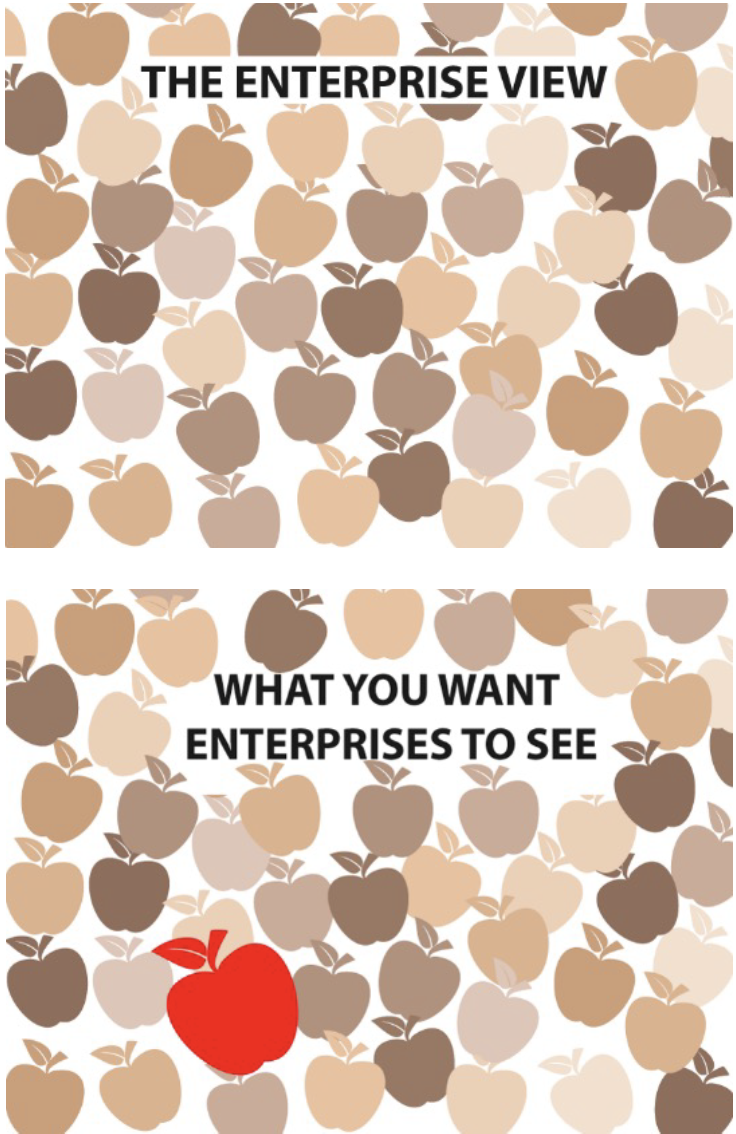

50 Shades of Beige

This is what our industry looks like when looking at TEM provider solutions.

Some have a yellow interface. Some have blue. Some have this data field. Some don’t. Some collect invoices one way. Some collect them another way. Some have automation. Some have people.

Sellers say all day long they are the only ones who have something when five others have the same thing. I can’t tell you how many times we have heard a vendor pitch something and say, nobody else has this, and yet, we just got done seeing it on three other solutions, some of which had it two years ago.

There are differences, but so much looks the same.

We must quit pitching our differentiators as features and functionality and instead pitch the value and business results we bring to the partnership as differentiators.

We can’t tell you how many times we have sat through three or four demos with a buyer over a few days and listened and watched the vendor say things like “we are the only ones that {fill in the blank}” or “let me tell you about our global capabilities” when the client doesn’t even want global in scope. And the list of stories like this goes on and on.

But here is where the real issue is that creates the “50 shades of beige” and the inhibitor to industry growth and both vendor and business opportunity. We have it all backwards, on both the vendor side and the business buyer side. So many believe the demo of the software is the most important thing. We will argue that it’s the least important thing. The vendors say, “can I show you a demo?” and businesses say, “can I see a demo?” And so, 50 shades of beige is what we get. It all looks the same.

The demo is the last thing that should happen in the process, not the first thing. The relationship, the sale, the long-term partnership, the business results and the value creation for the company and IT leadership is not created with the demo. It’s just the final mechanism to show how we are going to use the technology to create what really matters.

After reading this series, you should have a few ideas on what really matters. It’s not just another shade of beige. Here are a few.

Focus on what company leadership and IT leadership care about.

- What’s important to them?

- List what the two leader groups care about. Do they care about risks, do they care about revenue growth, do they care about market trends, do they care about security, do they care about competition, do they care about customer engagement, do they care about market perception?

REALLY differentiate yourself beyond features and functionality.

Focus on business results and outcomes not just small cost savings, in the scope of things, that only matter to a small group.

Plan, plan, plan and plan some more.

Address problems but focus on solutions.

Focus on the data and what it tells you

- Data and reports that REALLY matter.

- Inventory is more critical than anything.

Get beyond the day-to-day telecom, mobility, and IT management world for a minute. What do others care about? Understanding it and matching your solution and your environment to contribute to those initiatives is critical, for both the seller and the buyer… and partner together to make it happen. Don’t be another shade of beige.

Where’s the Data?

It’s All About the Information

We have gone from the agricultural world to the industrial world to the technology world and are now in an information world. Technology is a given. You must have it. But information drives the future. While we tend to focus on our technology and everything it can do, the real key is the information it produces and what you can learn and do with it.

As an industry, we are already behind other industries from a technology perspective, but we need to quickly advance our thinking to the information aspects of our industry. That’s assuming we want to capitalize on the significant opportunities for revenue growth on the seller side and the business value creation on the buyer side, which in turn will accelerate growth and respect in the industry overall.

- We spend too much time making decisions without data…we speculate, or we ‘think’ we know.

- Every seller / solution provider has significant amounts of data, which in aggregate can really contribute towards moving the industry growth needle. Maybe AOTMP® should be the aggregator of non-identifiable industry data from the buy side and sell side?

- Down at the day-to-day execution level, we don’t spend enough time learning what the data tells us and how we can use it to contribute to results / outcomes.

- This industry in general talks more about problems and looking backwards than it does looking forward, all without the facts.

- Using data and solving problems together is not the norm in this industry. If it was, we wouldn’t have the churn and we would be much further ahead.

- Data tells the story of results. Data helps us create and plan for the future. Data helps us make decisions.

- We all talk about reports and data, but we need to spend more time talking about outcomes and plans.

And speaking of data, arguably the most important set of data is in inventory. In more than 20 years in this industry and seeing inventories from thousands of environments, we have seen one, yes one, inventory with a 90% or higher degree of accuracy that was kept current and accurate.

Everyone has an inventory. Everyone has a different definition of inventory. Everyone has a different level of inventory. Very few keep up with their inventory or have it captured globally, to where there is 90% or greater confidence in the data. The number of businesses that want their TEM provider to provide an inventory but don’t want to have the TEM provider incorporate their move, add, and change process into it is alarming. Or the businesses that don’t incorporate contract changes into their inventory. The inventory should be accurate, and it should be the SOURCE OF TRUTH, trusted by everyone. It feeds reports. It feeds contract negotiations. It feeds other departments, and other departments feed it. It should be the most important set of data in every telecom, mobility, and IT management environment. Yet, we see business after business that doesn’t want to invest what it needs (time, money, process change, etc.) to keep an accurate inventory. Again, a perfect case of potential value beyond cost savings. The inventory is everything.

How do you define an inventory and how do you define an accurate inventory? We will have to save this for another time, but suffice it to say many have tried to define it and while it might work for them, there hasn’t been a universal adoption in the industry. You can however say, when thinking about telecom, mobility, and IT management, it starts at the highest level, with an inventory of services, contracts, devices, and licenses. Then it can get very deep from there. And by the way, it’s not just an invoice inventory, as we often see.

The main point is the industry has very few accurate inventories, even when it comes down to just telecom and mobility services only. And no doubt about it. It’s hard. It’s not easy. Things are changing daily. But then, you don’t build an NFL championship football team or win the Olympics with “easy”. It takes a lot of blood, sweat and tears. Same with a world class telecom, mobility, and IT management environment or Center of Excellence as we would like to see. It takes a lot of hard work, investment, and commitment. It’s not easy. And of course, investment, buy-in and hard work comes easier when strategic business value is created.

Investing in an accurate inventory is critical to providing value to the business, providing growth opportunities for the seller side and the buyer side, and in turn contributing to industry growth. If everyone who uses or needs to rely on the inventory data doesn’t have a 90% or higher confidence level in the inventory, you aren’t there yet.

The Impact of Private Equity

Over the years we have seen the impact of private equity, both from a positive and negative perspective. Overall, private equity has been good for the industry and has definitely helped grow the industry to where it is today. But we will also argue that private equity has driven unwanted consequences and thwarted overall industry growth down at the business customer level.

From the outside view of AOTMP®, meaning our view of the buyer side and the seller side, and having both as our customers, we have seen the following:

There is often a push from private equity to position for a future sale and it oftentimes becomes more about that than anything else.

- There is a push by private equity for more automation and less people in an industry where the buyers are looking for guidance and expertise in addition to automation. The advice from the TEM provider is often of most value to the buyer, and yet we have seen so much expertise leave this industry, creating challenges for the buyer side.

- There is no doubt about that it’s more difficult to scale a business and an industry based on people than it is with automation.

- In this industry successful business telecom, mobility, and IT environments have four common components.

- Technology: A great technology from an outside provider.

- Expertise: A great provider of expertise of best practices (knows what works in other like-kind environments). This is oftentimes the same as the provider of the technology.

- Company Knowledge: The internal knowledge of the business must be in place (the people on the buyer side).

- Internal Support: Strong support from IT leadership is critical.

- Fully outsourced environments typically don’t get the best results. Fully internally managed environments typically don’t get the best results. A hybrid approach with the four components above typically gets the best results.

- We have seen three waves of expertise over the years. First, there was a lot of consulting being provided. Then we started seeing that knowledge and expertise going away with a heavy technology push. Now we are back to gradually seeing the importance of expertise coming back into the equation.

- There are far too many low-ball bids just to win deals and get market share to satisfy private equity pressure or dominate the market, largely at the expense of providing the support the customer needs to have a successful environment.

We can’t tell you how many CEO’s and sales leaders have told us their strategy is to low-ball every bid to make sure they win it and then make it up with up-sells. They never get to the upsell as the implementation is poor, the ongoing service is poor, and the business buyer is “done” with them.

On a very related note, with more to come, we can’t tell you how many buyers / business customers buy based on the lowest price solution as 90% of the decision-making process. When the decision is mostly based on the monthly or annual cost and not on the value or business impact that is really provided or needed, we see high churn rates. That thought process is normally a death sentence for both the buyer and the seller and contributes to industry churn. Buyers and sellers need to get away from low cost selling and buying.

Back to the private equity. We are a big fan of private equity in this industry to fuel growth. We must have it and it’s a valuable tool for industry growth. However, we can also tell you we have seen well over $150 million in private equity lost in this industry, which is a significant number in our small industry. In fact, over $100 million of it was in just two deals that were part of roll-up strategies. On another day we can write a book about combining great companies and poor companies and the results. Then, we can follow with another book talking about the great outcomes for private equity players, sometimes at the expense of the customers.

The bottom line is that we think there is much greater opportunity for private equity. But we must first look at the fundamental issues in the overall industry and what can be changed in the model to drive more value for the buyers’ organizations, more value for the TEM providers and, in turn, larger outcomes for the investors.

Working Together is Gone, or is it?

What happened to reality and common sense? What happened to the spirit of partnership? Where is the leadership? How do we ever grow as a business, as a vendor, or as an industry with such a lack of true partnership? We just do not see partners that often. It’s not that they are not there, we just don’t hear about them or see them. On the contrary, we hear about the issues from the business side and the vendor side almost daily. Vendors are talking about their customers and their challenges and businesses are talking about their vendors and all the things they are not doing well. Let’s talk about something else.

This is a very complex and tough industry with the carriers and providers and all the moving parts as it is. We cannot afford to make it even more difficult amongst ourselves. We must work together, and we must have true partnership. Some of the greatest technology (or other companies) in the world are built on working together to solve challenges. They are not built on focusing, practically non-stop, on problems, like we often do in this industry. Great global companies are built by multiple groups or teams or organizations coming together, understanding the challenges, talking about them, and then working together to solve them. But most importantly, they stay focused on working together to create the future that others, including their internal and external customers, will want to be part of. Again, while there are successes in the industry, they are far outweighed by challenges. We must change that by focusing on what we can control…together…buy side, sell side, and investor side.

Like we said in the Series Overview, there are lots of great success stories and we don’t want to discount them, but there still isn’t enough success to make it a thriving industry.

We look forward to the day when we hear about the challenges we conquered together, the business value stories we created together, and the future we created together. It can be done, and we can do it. Like we have previously said, it starts with one vendor and one business customer at a time—two parties coming together to create value and to create business impact.

Then, it becomes two vendors and two customers and the TEM Industry, Act 2, story begins … the evolution into what it can and should be.

A Few of Our Favorite Stories and Themes

The businesses who tell us they are saving $1 million every year on a $10 million spend and are proud of it. Shouldn’t it be free by now?

The leaders who have threatened to throw us out of their office if we showed them how to save $20 million a year with their TEM provider.

- Makes me look bad and the CFO will take it from my budget.

- Find me a way to reallocate the $20 million and you can stay.

The guy who got fired because his provider found him a $5 million credit. This guy could not have possibly found everything in his huge environment.

The TEM provider(s) who tell us they have no churn. And we just talked to two of their customers the day before who said they left the provider.

The President of a nearly $100 billion company who invited us to his office to hear our three-bullet pitch on how his telecom, mobility, and IT team could help drive up his revenues by 3%.

- He had no idea his TEM program saved him $50 million over the past 12 months and didn’t care.

- His primary concern was that his company’s network performance was “slowing down” because of all the sudden cloud-based service demand on the network.

- We will talk later about the three-bullet strategic pitch that got his attention.

The countless vendors who tell us (or show us) they are the only ones in the industry that have x, y and z. And we just got off the phone with two vendors earlier in the week who have had it for years.

The countless businesses who blame everything on their vendors when it is truly in their own shop. They forgot to take a hard look in the mirror that morning.

The countless times we have heard “we are the only ones that [fill in the blank]”. And we have seen it implemented in four other business environments in the last two months.

The organizations we have spoken to or gone into where the mobile team and the fixed teams will not even talk to each other.

- No, it’s worse than that in some organizations…a vendor cannot even do a demo back-to-back with the business fixed and mobile team as then they would have to pass each other coming and going from the same conference room.

- Where is the leadership?

And while we see and hear all these stories and many just like them, one of our favorite questions of all time to ask both businesses and vendors in this space is “how do you measure and show value beyond cost savings?” If I had a dollar for every blank stare we have gotten…and therein lies one of the biggest fundamental issues in our industry.

Opportunities are Everywhere

There are significant opportunities for businesses, for vendors, and for financial partners.

We have continually said to industry vendors, you can go without generating one new logo in the next year and significantly increase your revenues. There is so much business and opportunity in your own customer base.

We have continually said to businesses, you can go for a year without investing another nickel and create significant opportunities to lower risk, increase efficiency, and create more value.

The buyers and sellers can both make significant contributions by focusing on strategic outcomes and by understanding and resolving the root cause of inhibitors that limit strategic outcomes. Remember root cause. It’s so important. More on that later.

The Fundamental Areas of Improvement

AOTMP® has identified the following five areas of improvement that need to be addressed before we can begin to build a multi-billion-dollar industry, providing increased benefits to business, vendors, and financial partners.

Improving the buy and sell process.

Agree to open and transparent communications throughout the process, regardless of the issue.

Developing stronger vendor – customer partnerships.

Problems are going to happen; commit to focusing on solutions, not penalizing each other.

Focusing on creating or realizing value beyond cost savings.

Help each other identify, quantify, and realize value beyond cost savings.

Building world class telecom and mobility management Centers of Excellence.

Work together to build environments that contribute to overall strategic business results.

Accelerating buyer and seller growth opportunities.

Help each other identify opportunities for growth in their respective business.

Background

AOTMP University delivers online training and certifications to the Telecom, Mobility, and Cloud / IT management industry.

After 20 years in business, we know what works and what doesn’t. We see the great relationships. We see the churn. We hear about the great buyers and the unreasonable buyers. We hear about the effective and the ineffective vendors. We see the buyers who will never have a successful TEM program until they change internally. We see the sellers who will say anything and go beyond reasonable ethics to get a deal. We hear the vendors who say they have never lost a customer, yet we can easily dispute it. We see the enterprise buyers who put 100% of the blame on their vendor, yet the greatest challenge is within their own organization. We see the many happy relationships and we see the many relationships that just exist because it’s too painful to change. And we see the investor wins along with huge investor losses in the tens of millions. We see it all.

Armed with this experience, we have decided to author this eight-part series, not to just point out all the challenges, but to bring awareness to all the growth opportunities right in front of us if we can work together to affect change. It must start, and it starts with one vendor and one buyer, then two vendors and two buyers and builds from there.